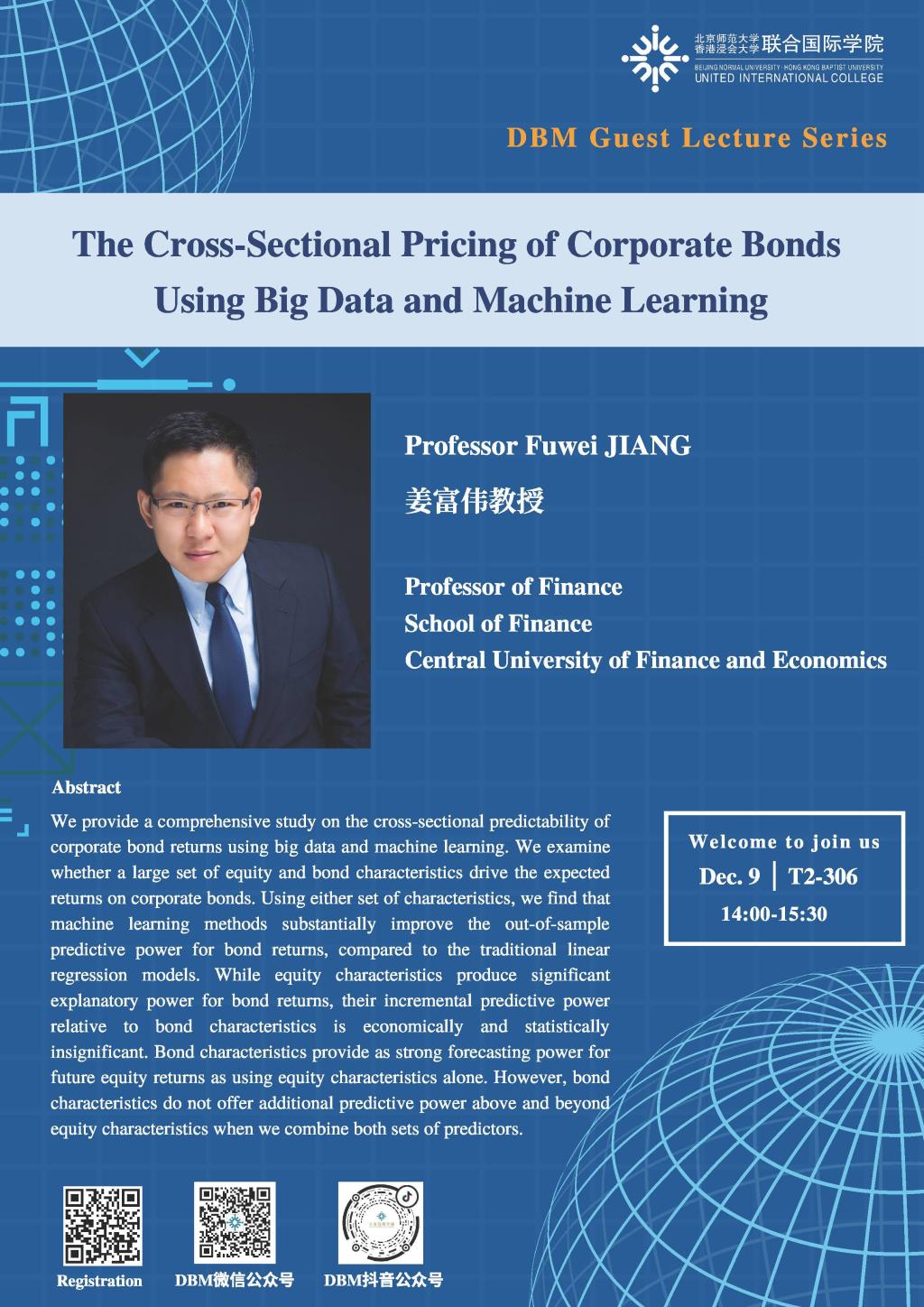

9 December 2020 - DBM Guest Lecture Series_The Cross-Sectional Pricing of Corporate Bonds Using Big Data and Machine Learning

Abstract

We provide a comprehensive study on the cross-sectional predictability of corporate bond returns using big data and machine learning. We examine whether a large set of equity and bond characteristics drive the expected returns on corporate bonds. Using either set of characteristics, we find that machine learning methods substantially improve the out-of-sample predictive power for bond returns, compared to the traditional linear regression models. While equity characteristics produce significant explanatory power for bond returns, their incremental predictive power relative to bond characteristics is economically and statistically insignificant. Bond characteristics provide as strong forecasting power for future equity returns as using equity characteristics alone. However, bond characteristics do not offer additional predictive power above and beyond equity characteristics when we combine both sets of predictors.

About the Speaker

Dr. Jiang received a Master and a Ph.D. in Finance from Lee Kong Chian School of Business, Singapore Management University. His main research interests are asset pricing, return predictability, investment, behavioral finance and entrepreneurial finance. Also, he teaches Empirical Methods in Finance and Financial Markets and Institutions for CUFE undergraduate, MSc. and Ph.D. Furthermore, his papers have appeared in Journal of Financial Economics、Review of Financial Studies, and other finance journals.